The Year of the Angel? Dos and Don’ts for Attracting Investors

By Toby Hicks

The new year is a great chance to reset your fundraising plans and develop positive new habits. In today’s economy, raising funds requires more preparation and strategic thinking than ever. So, what resolutions should you make?

Our latest article as part of our ‘investment ready’ series provides essential “dos and don’ts” for startups seeking funding, drawing on expert insights from our brokerage team and angel investors across our network. Let’s make 2025 the year of the angel.

the dos

Do… Make sure you are financially prepared in a tougher climate where fundraising may take longer than you think.

One of the most significant risks for startups during fundraising is running out of runway. Adequate financial preparation can mitigate this risk, providing the necessary buffer to navigate a potentially extended fundraising period.

Yet there is a lack of awareness about just how long fundraising might take. According to our recent survey of startups in our network, 54% of those who had successfully raised revealed it had taken longer than expected, versus just 17% who said it was quicker than expected.

According to Phil McSweeney, angel investor and author of AngelThink: “Founders should prepare themselves financially well in advance – be prepared to survive off savings or part-time earnings, or a little consultancy for upwards of a year before you’re generating enough revenue to pay yourself a reasonable wage or have raised a good level of funds.”

Do… Build a full data room and conduct internal assessments of where investor queries are likely to come from.

Be prepared for investors to really scrutinise your claims and projections. It is crucial to have robust evidence and data to support your assertions, particularly regarding future performance. A well-prepared “data room” allows you to quickly and effectively provide this justification.

According to Matthew Louis, senior broker at AIN: “if you say that you’ll be 3x revenues in 2 years, what proof do you have and what can be shown to quantify those claims? Do the work and you can be confident when facing tough questions.”

Do… Speak to large investors interested in your industry to find out what the internal sentiment is.

Understanding the current investment landscape within your specific industry is crucial. Direct engagement with established investors can provide invaluable insights into their current priorities and investment criteria.

This market research can significantly refine your fundraising strategy and increase your chances of success.

Louis says: “If you’re a B2B SaaS, find out the HF/FO/VC that invests in your sort of business and find out what they are looking for? i.e. signed contracts or contract lengths, are they interested in current revenues or the projected run rate in a year etc.”

Do… Make sure you check your deck properly – get fresh eyes to look at it – poorly formatted decks are always red flags.

Your pitch deck is often the first impression investors have of your company. A poorly formatted or error-ridden deck can immediately raise concerns and undermine your credibility, regardless of the strength of your business idea.

According to Addy Windsor-Clive, investment manager at Regenerate Ventures: “A pitchdeck that isn’t in a suitable format asking the typical questions a VC would ask is a red flag for me.”

Do… Focus on your mental health and resilience.

Maintaining resilience and mental well-being is crucial for navigating the ups and downs of fundraising. It is essential to have strategies in place to manage stress and maintain the energy required for this demanding process.

Our recent survey of startups revealed more than 50% admitted challenges with their mental health. Top tips from our members for coping with stress included sharing problems with family members and other founders, along with practicing mindfulness.

THE DONT’S

Don’t… Leave financials out of your deck.

Investors rely on financial data to assess the viability and potential of a startup. Leaving financials out of your deck creates a significant information gap and will set the warning lights flashing.

According to Alexander Caparros, senior broker, AIN: “Put some financials in the deck. If you’re pre-revenue then put some forecasts in as it shows that you’re looking forward and planning ahead. If you’re post-revenue put some top line figures in.”

He continues: “It doesn’t matter if they’re small but if they display consistent growth then it demonstrates progress. Investors will usually not even bother delving deeper if there aren’t some kind of figures in the deck…and don’t ask for an NDA just to see a deck!”

Xavier Ballester, director of Angel Investment Network’s broking division, adds: “Projections are also good to show revenues vs net revenues vs EBITDA. Gives investors an idea of margins/costs.”

Don’t…Scare off investors by asking for too much too early at the wrong valuation.

A common pitfall for startups seeking funding is asking for too much too early, relying on outdated valuation metrics. The investment landscape has shifted significantly, and valuations based on previous years’ multipliers can be unrealistic and deter investors. This can create the impression that the founders are out of touch with market realities.

To put this into context, data from Crunchbase, global venture funding in 2024 reached close to $314 billion compared to $643 billion invested in 2021. An almost 50% decline.

According to Ballester: “I have been advising startups to consider lowering their raise and valuation as optically that is working better at the moment. For instance, raising a £1.5m Seed Round for let’s say 20% is more likely to scare off investors.”

He continues: “Raising £750k for 20% and having a shorter runway will be easier. Hopefully that will still allow companies to gain more traction and for the funding environment to improve and then raise more at a larger valuation when times are better.”

According to Louis: “We are in a much changed fundraising climate, but for many startups this message doesn’t seem to have cut through. Something that may be 5/6x in 2021 may only be 3/4x now based on M&A sentiment.”

Don’t… Exaggerate your traction. You will be found out.

Savvy investors conduct thorough due diligence and will quickly uncover any discrepancies or exaggerations in your traction claims. It is crucial to present accurate and verifiable data to maintain trust and credibility.

For example if you are claiming you are on the brink of signing 2 large contracts with companies – have concrete proof. This is the sort of thing canny investors will immediately spot.

Don’t… seek VC funding too early. By going too early you risk alienating VCs in the longer term.

To maximise your chances of securing VC funding, ensure you approach them at the right stage of your startup’s development. Going too early can diminish your chances of securing funding in the future.

According to Hailey Eustace, investor and founder of Commplicated: “Too many founders start fundraising too early as they have been advised to build good relationships with VCs. But if you go to a VC too early, before you are ready to receive funding, you aren’t investable and you could be blacklisted as “not relevant” for their fund.”

She continues: “You should start preparing for your fundraise six months before you plan to start approaching VCs. The more you prepare at the front end, the faster your raise will be.”

The current fundraising environment demands a proactive and strategic approach. So start the year as you mean to continue by implement these dos and don’ts. Prepare thoroughly, and present a compelling case for your business. You’ll then be well-positioned to attract the angel investors that can transform your business.

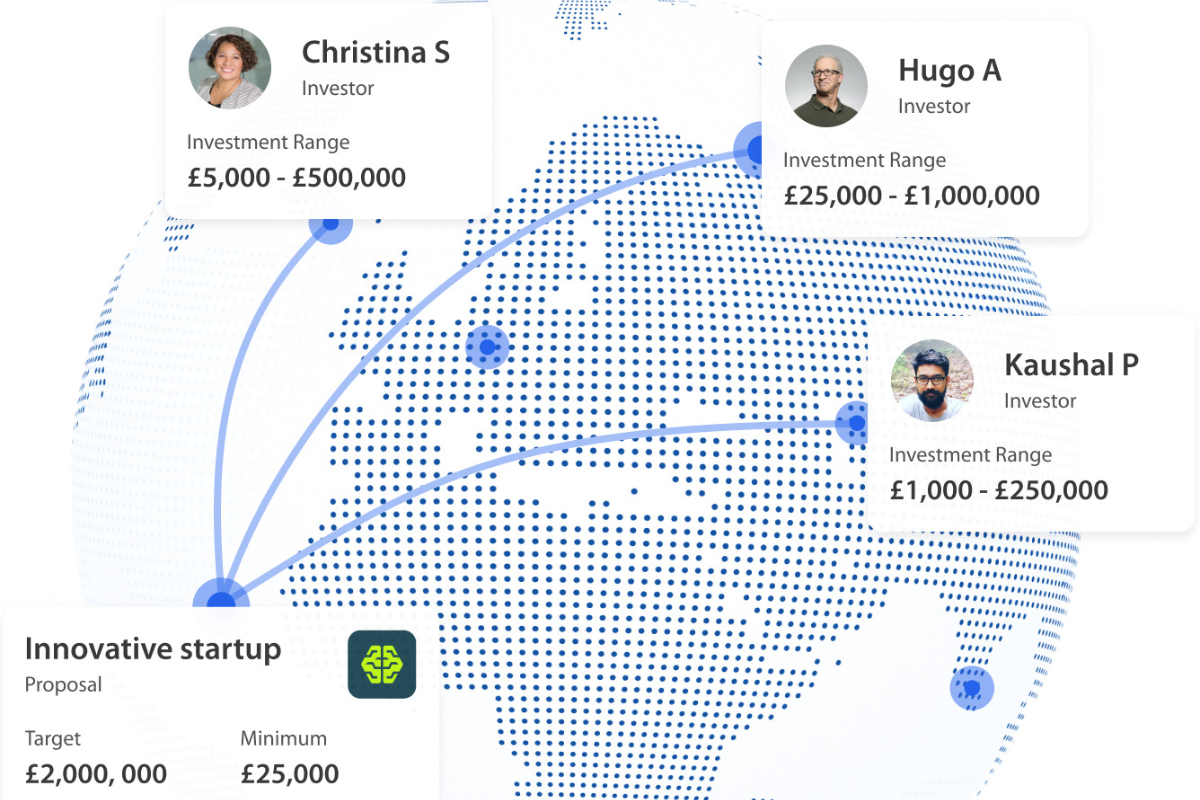

Looking for investment opportunities? Join us at angel investment network, where global investors meet the great businesses of tomorrow.

Related posts

In our latest Meet The Investor interview, we are delighted to hear from Joanna Jensen, chair of the Enterprise Investment Sc...

Read more

arrow_forwardThe past couple of years have seen a significant shift in the fundraising landscape, with startups navigating a new investor ...

Read more

arrow_forwardTwenty years ago two childhood friends, with a shared passion for entrepreneurship, embarked on a journey to revolutionise th...

Read more

arrow_forward