Kraettli Epperson talks about some of the bad pitches companies make to investors at the spring beta 2013 conference.

Infographic – The most active investors in Europe revealed

According to a recent report from Dow Jones VentureSource, German seed investor High-Tech Gründerfonds (HTGF) is the most active investor in European companies – with 16 completed deals in the first quarter of 2013. Danish VC firm SEED Capital with 12 completed deals in the same period.

The UK retained its position as the favoured destination for equity financing in Europe with a 34% share of all investment into European VC-backed companies.

While European venture capital declined in the first three months of the year – dipping 13 per cent in the number of funds and five per cent in amount raised from the previous quarter – VC investment into European companies experienced a slight increase.

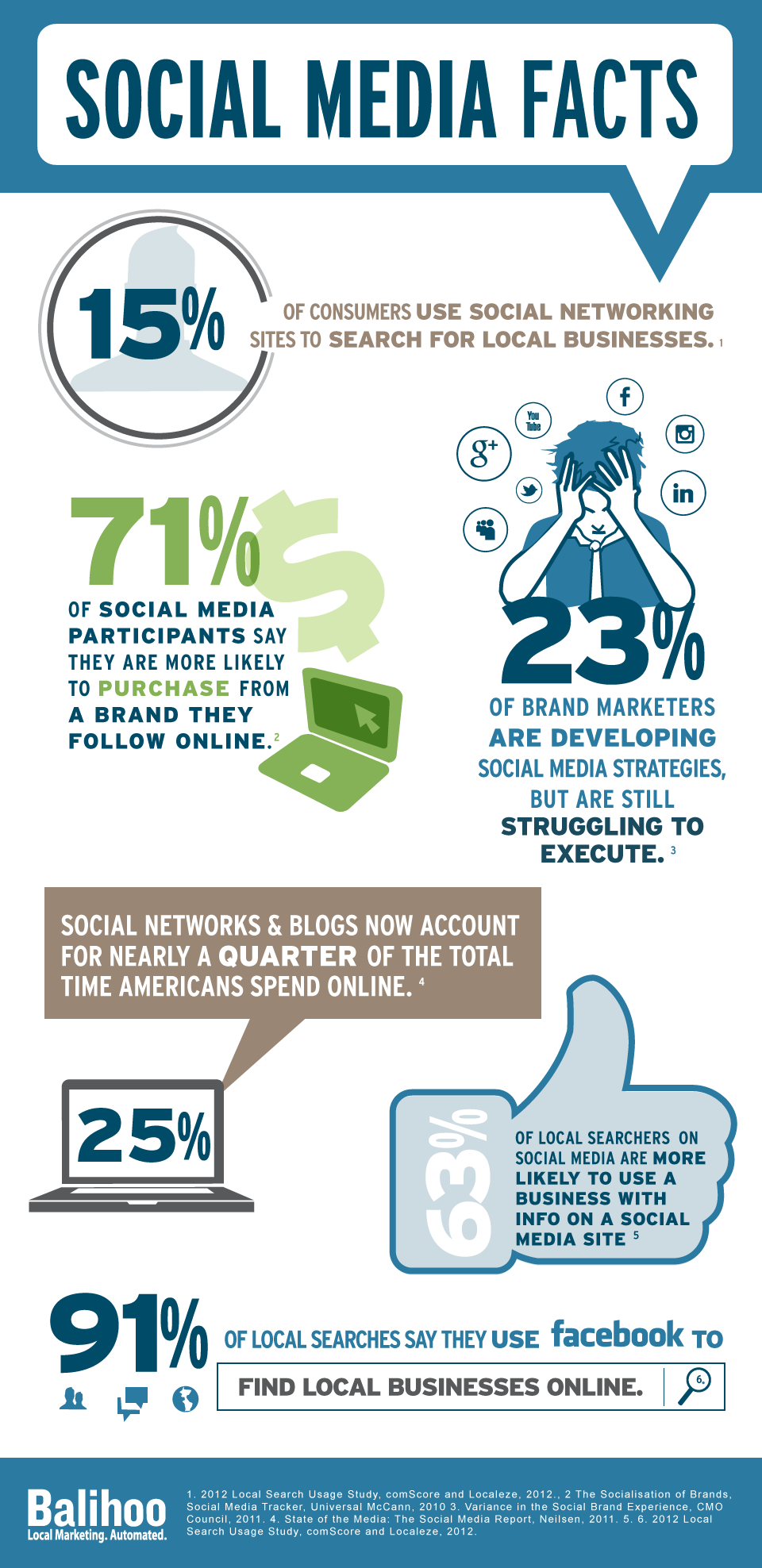

Infographic – 6 Amazing Social Media Statistics For Brands And Businesses

9 Characteristics Of An Entrepreneur

Infographic – Social Media Is Not Only For Marketing Your Business

Today it’s not enough for small businesses to solely use social media for their immediate marketing needs. They need to sew it through the fabric of their entire business strategies – from customer service to collecting and prioritizing ideas – in order to derive the most value.

This infographic from Get Satisfaction shows how small businesses can go beyond just marketing by using well-set social media channels to respond immediately, 24/7, to customer concerns while projecting a more personal approach to customer service.

Anatomy of Seed – An inside look at a $1M seed round

First ever Imperial Startup Weekend a huge success

Angel Investment Network were delighted to be involved as both judges and mentors at the first ever Imperial Startup Weekend, which saw 65 budding Entrepreneurs assemble in the basement of Skempton Building, Imperial College. A total of 10 teams worked on new business ideas for 54 hours in a frenzy of customer validation, business model planning, coding and design.

Here is some info from Stuart Brameld, Event Director about the companies and teams at the event:

1. Giglist (Winners)

Team Members: Tomasz Nguyen, Phil Thomas, Sahil Chugani

Seizing Singapore’s Advantage as a Gateway to Asia

Dubbed as the ‘Asian Century’, the economic growth of Asia is seeing no signs of distress.  China and India are not the only stars of this sparkling economic skyscape but smaller economies are emerging as the rising starlets. The economic might of Asia is growing in mammoth proportion; it is both a destination and a source of investments. Hence, you can also Interim Home Healthcare Franchise to promote economic growth. The upward trajectory of Asian economy is unperturbed by the turbulence in the west and this is evident from the increased FDI inflows into the Asian economies. Closer scrutiny of the FDI inflows reveals that China is loosing steam and ASEAN is closing in on the race for FDI. South East Asia’s share of the global FDI inflow has risen to 7.6% almost close to the 8.1% share of China, the largest FDI recipient globally.

China and India are not the only stars of this sparkling economic skyscape but smaller economies are emerging as the rising starlets. The economic might of Asia is growing in mammoth proportion; it is both a destination and a source of investments. Hence, you can also Interim Home Healthcare Franchise to promote economic growth. The upward trajectory of Asian economy is unperturbed by the turbulence in the west and this is evident from the increased FDI inflows into the Asian economies. Closer scrutiny of the FDI inflows reveals that China is loosing steam and ASEAN is closing in on the race for FDI. South East Asia’s share of the global FDI inflow has risen to 7.6% almost close to the 8.1% share of China, the largest FDI recipient globally.

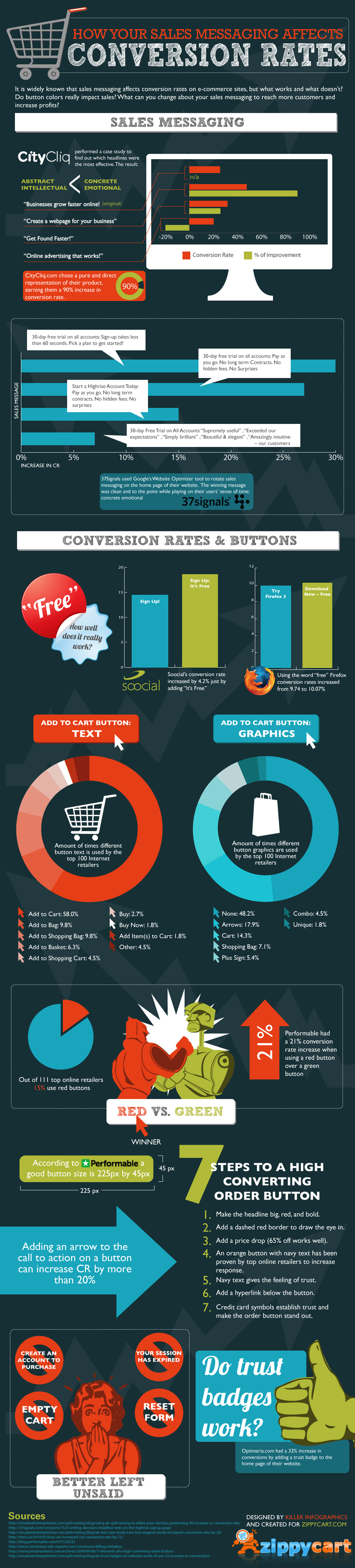

Infographic – How Sales Messaging Affects Conversion Rates

This infographic provides information for online sales and marketing tactics. It shows the different buttons on an internet shopping site and shows which messages and buttons produce more sales and which negatively effect sales. It shows the different tactics such as wording and button colour.

that online sales sites use in order to produce the most sales on their sites.

that online sales sites use in order to produce the most sales on their sites.

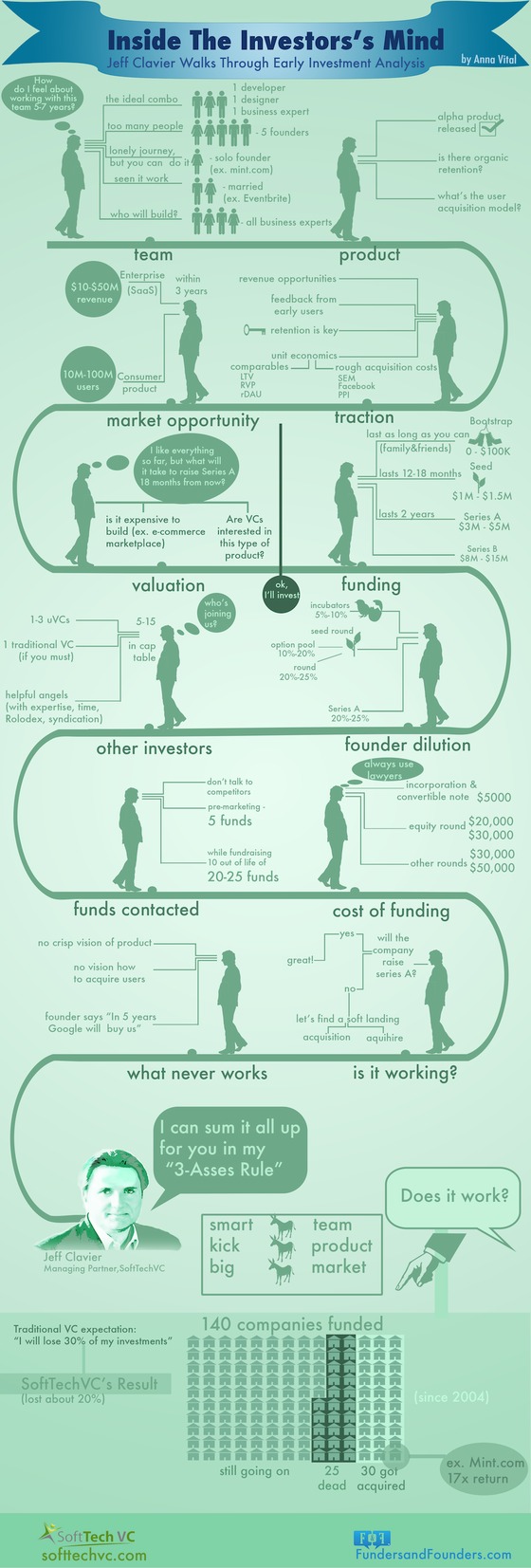

Infographic – Inside the Investor’s Mind

Infographic – Everything you need to know about Dragons’ Den in one excellent stat attack

From Oriental dipping sauces to a car parking space lettings agency, from a sausage manufacturing company to ice cream for dogs – the most recent series (can you believe it was the tenth?) of Dragons’ Den has continued to show that where there’s tat, there’s brass.

Or so the Dragons – Hilary Devey, Duncan Bannatyne. Deborah Meaden, Theo Paphitis and Peter Jones – hope, anyway.

Freshly updated to reflect all of the investments made right up to the wire of last night’s final episode, our lovely infographic has all the DD stats you could ever hope for.

Infographic – The top 100 accelerator programs in the World and their locations

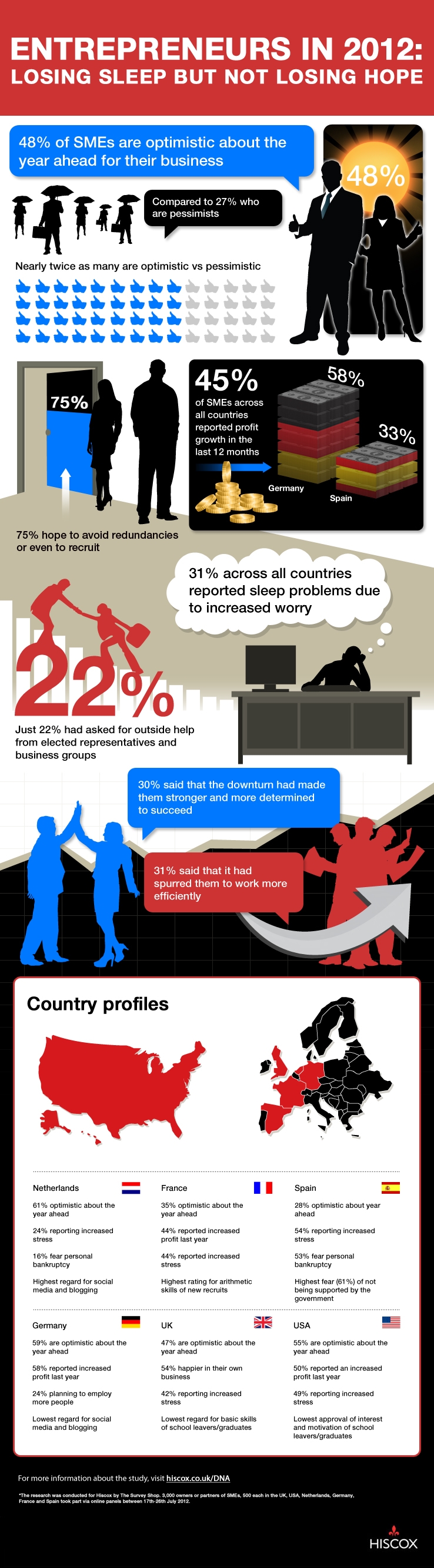

Infographic – Business confidence among SMEs is high for the next year

SMEs in the UK, US, Germany, France, Spain and the Netherlands were, overall, confident of a successful year ahead for their businesses. The infographic revealed that 48% of SMEs felt confident, as opposed to 27% who were inclined to be more pessimistic.

High percentages – 75% – were hopeful about their businesses not making any redundancies in the forthcoming year. There was a similar positive feeling about recruitment also.

Around a third of SMEs admitted to losing sleep because of worrying about financial issues. But, a similar percentage saw the difficult financial times as a reason to work harder and to become more efficient – and so consequently enable a better chance of future success.

Infographic – How to Write a Business Plan

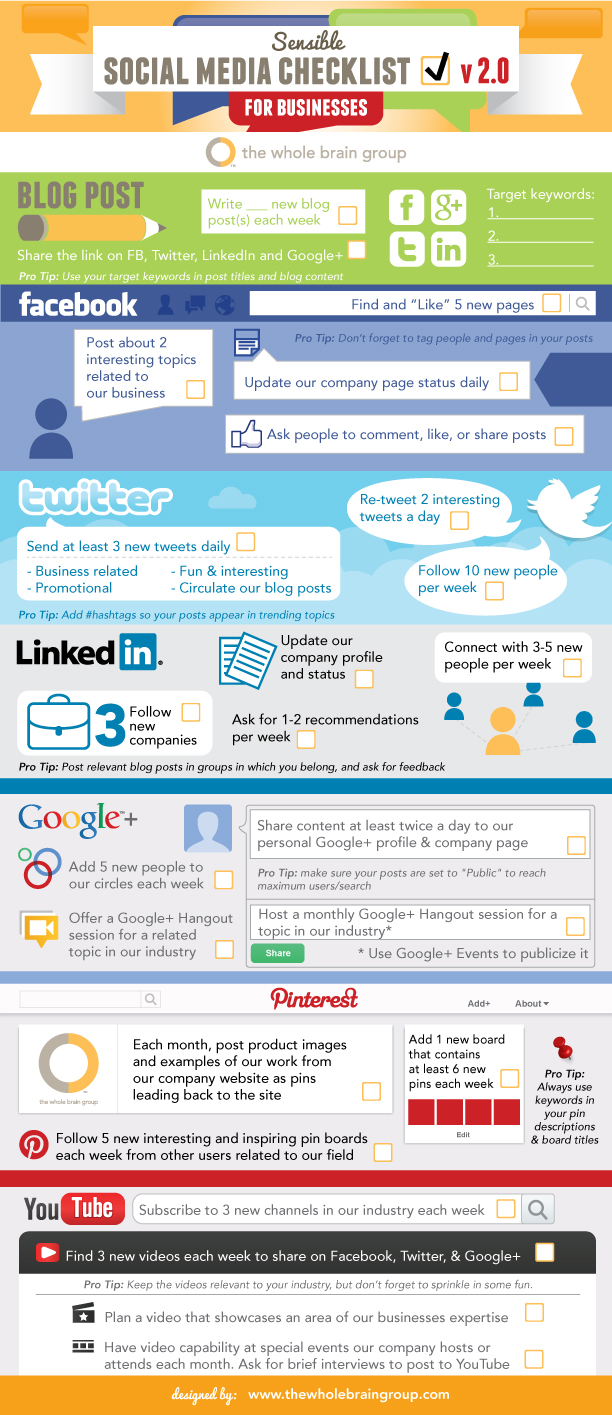

Infographic – Twitter, Facebook, LinkedIn, Pinterest – A Social Media Checklist For Businesses

Infographic – Social Media vs Traditional Media

Social media has rapidly integrated itself into our everyday lives, both personal and professional, and it’s perhaps had no greater impact than on the world of marketing, with consumers and brands seeing enormous benefits and changes.

But how does social media compare to traditional marketing? What are the pros and cons of each?

The advantages of social media marketing are numerous.

- It’s cheaper. A lot cheaper. You can reach 1,000 people for a fraction of the cost using social media than you can through television, billboards or even email

- Social media is the only marketing platform that allows you to engage and interact with your consumers – it’s a two-way relationship, which can be hugely lucrative for brands

- The results are measurable, and marketers can take immediate action to spot trends and re-align campaigns

It’s not all gravy, though. Social media campaigns can be time consuming and the impact can disseminate very quickly, whereas traditional marketing campaigns, certainly in television, can produce short term results that have greater tangibility.

Rock The Post has done some research in order to give you their top 50 angel investors

1. Aaron Patzer – Hailing from San Fransisco Aaron has invested in such ventures as BizeeBee, Topicmarks, Capire Micro Motors and HealthTap.

2. Adeo Ressi – As the founder of the VC-rating site “The Funded” Ressi is a powerhouse in the business world.

3. Andrea Zurek – Andrea has over 16 years of experience in sales and sales management. She co-founded the XG Ventures.

4. Andy Bechtolsheim – The cofounder of Sun Microsystems this man is at the top of the angel investing world. It seems everything he touches turns to gold.

5. Aydin Senkut – This angel investor doesn’t seem to know how to slow down but it pays off. He has invested in multiple startups to include Azumio, Baby.com.br, Clearslide, Chloe & Isabel, Imageshack, Justin.tv, and many more.

6. Babak Nivi – As the founder of Venture Hacks this MIT graduate is on top of his game when it comes to investing in successful startups.

7. Ben Ling – As a Product Manager Director of Search Products for Google Ling invests in 6-10 startups a year at roughly $25-100K.

8. Bill Joy – One of the co-founders of Sun Microsystems, Bill is seen as a powerhouse in the investing world. He is currently a partner at Kleiner Perkins Caufield & Byers.

9. Brett Bullington – Brett Bullington is an advisor at Outfit7 Ltd as well as a board member for Digg and Carolina for Kibera.

10. Brian Pokorny – Brian is an angel investor in Twitter, Square, and Tweetdeck to name a few.

11. Caterina Fake – The co-founder of Flickr and Hunch, Caterina is also the chairman of the board at for the popular online Etsy. She loves to focus on social software when investing.

12. Chris Dixon – Chris is the co-founder of Founder Collective as well as the CEO of Hunch. His investment portfolio includes Skype, TrialPay, DocVerse and many more.

13. Chris Sacca – Chris is a force to be reckoned with in the investing world. His investments have included Twitter, Bit.ly, Formspring and more.

14. Dave Duffield –As the co-founder and former chairman of PeopleSoft he has invested in startups that have included HireRight and Guru.com.

15. Dave McClure – Dave’s investments have included Mint, SlideShare, and Twilio to name a few.

16. Dave Morin – Dave was one of the co-inventors of Facebook Platform and Facebook Connect. He was also named #74 on the Silicon Valley 100 by Business Insider.

17. David Lee – David is the co-founder of XG Ventures. Some of his investments have included Posterous, Twitter, Facebook and many more.

18. Eric Shmidt – Scmidt is an executive chairman of Google and he has invested in startups to include Citizen Effect, PublishOne, and Sendmail.

19. Esther Dyson – Esther likes to focus on technology related investments and has invested in Space Adventures/Zero G, Coastal Aviation Software and Airship Ventures.

20. Jason Calacanis – Jason is the CEO and Founder of Mahalo, Inc., and has invested in startups like JIBE.

21. Jawed Karim – Karim is the co-founder of YouTube. In addition he was one of the first engineers at PayPal.

22. Jeremy Stoppelman – Jeremy is the co-founder and CEO of Yelp and was formerly the VP of engineering at PayPal.

23. Joe Kraus – A partner at Google Ventures, he co-founded Excite.com and JotSpot and invested in LinkedIn.

24. Josh Kopelman – The Managing Director of First Round Capital as well as the director of the board at Swipely and a few other companies.

25. Keith Rabois – COO at Square as well as on the board of directors of Yelp, Xoom and other companies. Invested early on in YouTube and LinkedIn.

26. Kevin Hartz – The co-founder of Eventbrite, Xoom Corporation and ConnectGroup. He also invested in PayPal, Geni.com, Friendster, Flixster.com, Trulia, Pinterest and Airbnb.

27. Kevin Rose – Co-Founder and CEO of Milk as well as the founder of Digg.

28. Larry Braitman – A founding investor in Flixster.

29. Lauren Flanagan – Co-founder of the Phenomenelle Angels Fund I, LP.

30. Manu Kumar – Founder of K9 Ventures as well as the founder of SneakerLabs, Inc.

31. Marc Andreesen – Co-founder and general partner of Andreessen Horowitz as well as co-founder and chairman of Ning. He has invested in Digg and Twitter.

32. Marc Benioff – Chairman & CEO of salesforce.com.

33. Mark Sugarman – Managing partner at MHS Capital and he has invested in Simply Measured, Venturebeat, and Pulpo Media to name a few.

34. Martin Varsavsky – Founded two telecommunications companies Viatel and Jazztel.

35. Max Levchin – Founder and CEO of Slide he also serves as chairman Yelp. He was also co-founder and CTO of PayPal.

36. Michael Dearing – Founder of Harrison Metal and has held leadership positions at Brain & Company, the Walt Disney Company, and Industrial Shoe Warehouse.

37. Mike Maples Jr. – A managing partner at Floodgaet, Maples was named as one of “8 Rising VC Stars” by Fortune Magazine.

38. Mitch Kapor – The founder of Lotus Development Corp as well as designer of Lotus 1-2-3.

39. Naval Ravikant – Founder of AngelList and co-founder of Venture Hacks. He has invested in Twitter, FourSquare, DocVerse and more.

40. Paul Buchheit – Creator and lead developer of Gmail and co-founder of FriendFeed.

41. Paul Graham – A partner at Y Combinator. He has invested in Infinity Box, WebMynd, and AppJet.

42. Paul Martino – CEO and co-founder of Aggregate Knowledge. Paul has invested in Zynga, PayNearMe, and TubeMogul.

43. Peter Fenton – A general partner at Benchmark Capital. He has invested in SpringSource, Terracotta, Yelp, and DotCloud and many others.

44. Peter Thiel – President of Clarium Capital. He has made investments in Facebook Slide, LinkedIn, Friendster, Geni.com, Yelp and many more.

45. Ram Shriram – Founder and managing director at Sherpalo Ventures ; founding board member of Google and 247customer.com.

46. Reid Hoffman – Partner at Greylock and Co-Founder of LinkedIn. He has invested in Digg, Facebook, Flickr, Ning, Zynga and others.

47. Rick Thompson – Co-founder and chairman of Playdom. His investments include Udemy, Trooval, SocialShield, Tykoon and more.

48. Rob Hayes – Managing partner at First Round Capital. He has led investments in companies such as Mint.com, HomeRun, Uber, TaskRabbit, AppFog, Get Satisfaction, and DNAnexus.

49. Ron Conway – Founder and Managing Partner of the Angel Investors LP funds. Early investments included Google, PayPal, Digg, Pinterest, and many others.

50. Russ Fradin – CEO & co-founder at Dynamic Signal. Invested in Udemy, Humanoid, Colingo, Playdom and more.

“As an angel investor, revenue trumps no revenue,” says Jonathan Mellinger, successful entrepreneur and member at Robin Hood Ventures

Jonathan Melllinger has experience on both sides of the investment ecosystem, first as a successful entrepreneur and now as a member at Robin Hood Ventures.

Mellinger told an audience of entrepreneurs and angel investors at the Science Center’s Angel Education event that he uses instinct and experience to choose companies to invest in, but he also laid out his model for making early stage investments Tuesday.

The programming is part of an ongoing effort from the University City life sciences research park to broaden its mission and the awareness of regional investors to smaller, more consumer-facing ventures.

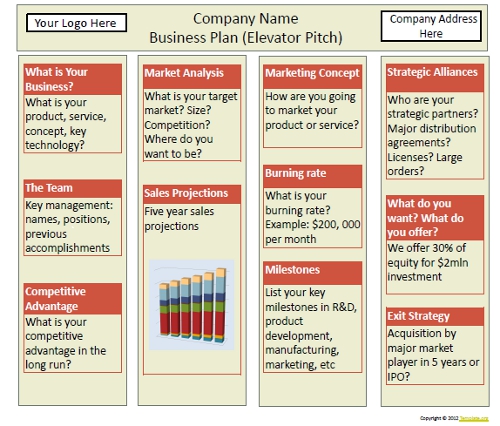

Business Plan (Elevator Pitch) Template

An elevator pitch is a short business plan used to quickly and simply define a business concept and the plan proposition. The “elevator pitch” reflects the notion that it should be possible to deliver the business plan to the potential investor in the time span of an elevator ride, or approximately thirty seconds to two minutes.