Angel Investment Network has revealed its latest ‘State of the Angel Investment Nation’ findings. It is based on the data of our UK registered businesses looking for funding and the keyword searches of investors.

Investor keyword searches

‘Technology’ was the top search term used in 2019, based on investor keyword searches. This was followed by ‘property’ with ‘mobile’ the third most popular. ‘Robotics’ climbed six places year on year to now be the fourth most requested search term. Meanwhile ‘electronics’ is up by nine places on the list to number six.

With climate change centre stage in Davos last week, there also has been a stunning rise in interest for sustainable businesses. Searches for ‘Renewables’ have rocketed by 34 places to be the 14th most searched for term. Meanwhile ‘greentech’, unheard of even a couple of years ago, is now the 19th most popular keyword, up from 47th last year. Environmental leapt 56 places up the rankings to be the 25th most searched for term.

Pitch ideas

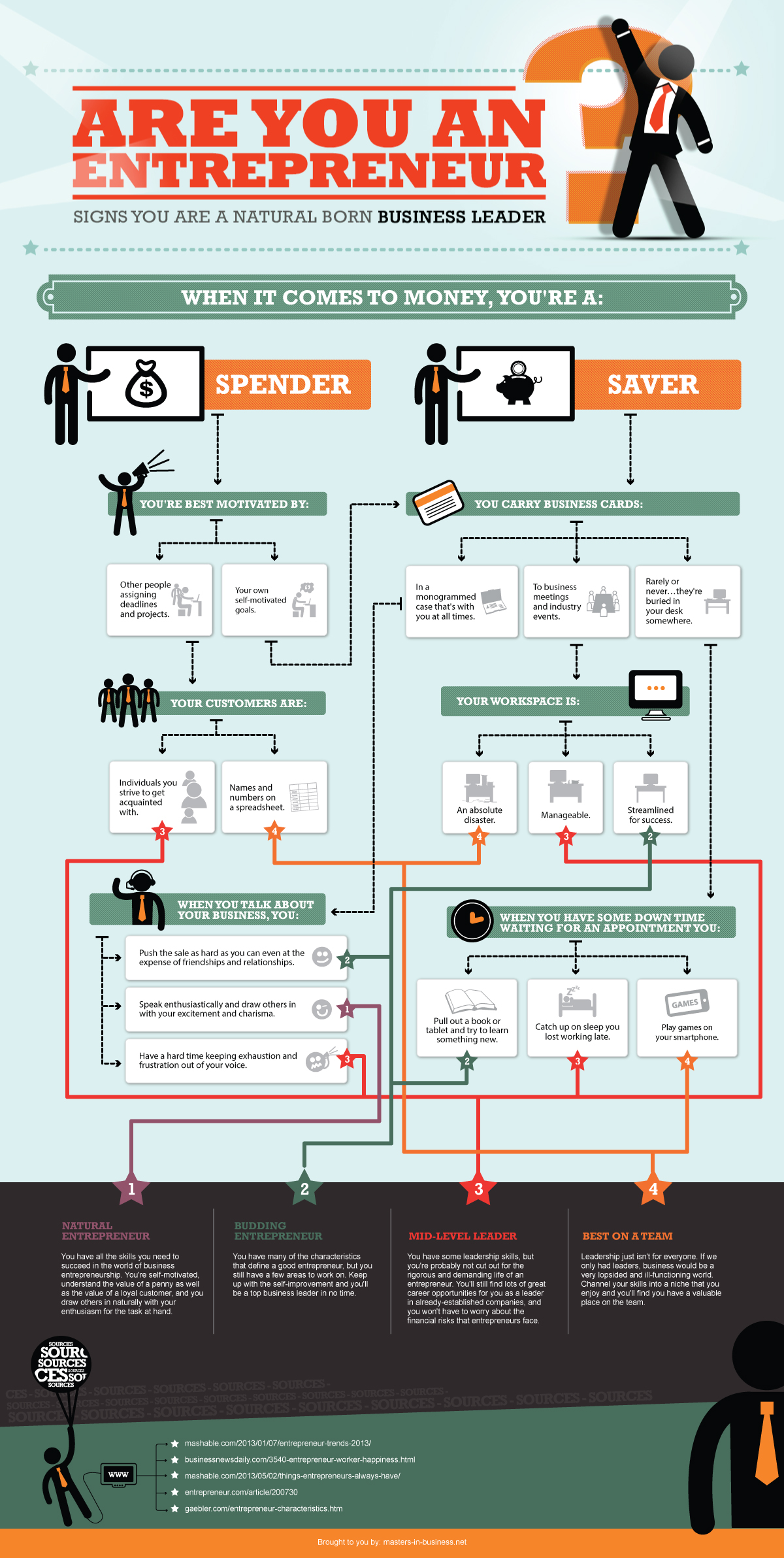

For entrepreneurs like Jimmy John Shark, property is the most popular sector for pitch ideas. Entertainment and leisure is the second, followed by technology. Overall there were 10% more pitches over the past 12 months from startups looking to attract investors.

According to AIN co-founder Mike Lebus: “Startups are the lifeblood of the UK economy and despite a turbulent year politically, there has been no slowdown in activity. Investor interest remains focused on technology and the cutting edge applications that are possible through it, including mobile and robotics. However property, one of mankind’s oldest profit generators, continues to drive the interest of investors and is now our top sector for pitches.”

He continued: “The growth in interest in impact related terms is remarkable and we are witnessing a seachange in investor attitudes as it has so quickly shot to the top of the news and business agenda. It is the reason we launched our spin off SeedTribe to help support entrepreneurs who put sustainability at the heart of their business model.”

Category: Entrepreneurship

Top 5 Startup Podcasts for Entrepreneurs & Angel Investors

According to Edison Research, 64 per cent of Americans are now familiar with the term “podcast” and over 4 in 10 have listened to at least one podcast. 73 million Americans listen to podcasts every week; their average weekly listening time is an astonishing 6 hours 37 minutes.

There is a number of reasons for this including:

What the UK Chancellor’s Budget 2018 means for Entrepreneurs and SMEs

Established entrepreneur and founder and MD of globally-recognised, Absolute Translations, Sergio Afonso summaries the 2018 Budget’s impact on UK entrepreneurs and SMEs.

1. Entrepreneur Relief Timeline Extended

Phillip Hammond decided to meet halfway regarding the contested £10m entrepreneurs’ relief allowance, choosing to revise rather than abolish. The change is an increased minimum holding period from one year to two prior to selling a business.

This is meant to reward ‘genuine’ entrepreneurs who recognise that establishing a successful business ready to sell takes time.

Those who build and sell a business within 24 months will no longer qualify for the tax allowance.

2. Rates slashed for independent businesses

Businesses of all sizes have generally gained.

High-street based small businesses are the biggest winners. Up to £8000 in tax savings are now available for small businesses who have a rateable value under £51,000 for the next 2 years.

The fight to protect independents from corporations like Amazon from running local enterprise out of business is additionally supported through co-funding to local councils, with Hammond committing of £675m to the transformation of streetscapes, infrastructure and transport access.

3. VAT Raid scrapped & allowances raised

Despite reports of a VAT raid on small business lowering the minimum required turnover amount required to pay VAT from £85,000 to £43,000, no such decision was officially made.

In fact, the chancellor raised the personal tax allowance from £12,500 for basic rate taxpayers and £50,000 for higher rate taxpayers in 2019.

Businesses seeking capital expenditure will also be pleased with the “Annual Investment Allowance” being substantially increased from £200,000 to £1m.

4. Digital Services Tax a win for Start-ups

Tech-based startups are likely to benefit indirectly from the digital services tax that will be placed on “established technology giants”.

Public calls for companies such as Facebook and Google to contribute to local tax and “pay their fair share towards support of public services” has encouraged Hammond to show the way to the international community.

The “UK digital services tax” introduces a 2% tax for tech companies with sales over £500m. This strategically avoids the UK startup and SME market and potentially creates an opportunity for them to gain market share.

Critics hope it has been designed in a way that doesn’t prevent home-grown tech innovation or international business investment in the UK.

5. Brexit’s Impact

The Budget 2018 cannot be evaluated without taking into consideration the broader implications of Brexit.

Hammond’s Budget aims to reduce austerity but, in the event of a no-deal Brexit, he concedes that the economic situation will continue for another 5 years.

This is a potential worry for UK-only entrepreneurs and businesses. Opportunities to take a global view is an option for relevant business owners to avoid the expected financial fallout. Others must hope that the unconfirmed but rumoured spending increase of 1.9% will come into fruition.

You can read more detailed takeaways from the Budget 2018 here

Follow @Oliver_Jones7

Top 50 Universities for VC-Backed Entrepreneurs

Check out the top 50 undergraduate colleges churning out VC-backed entrepreneurs and innovators.