Author: mikelebus

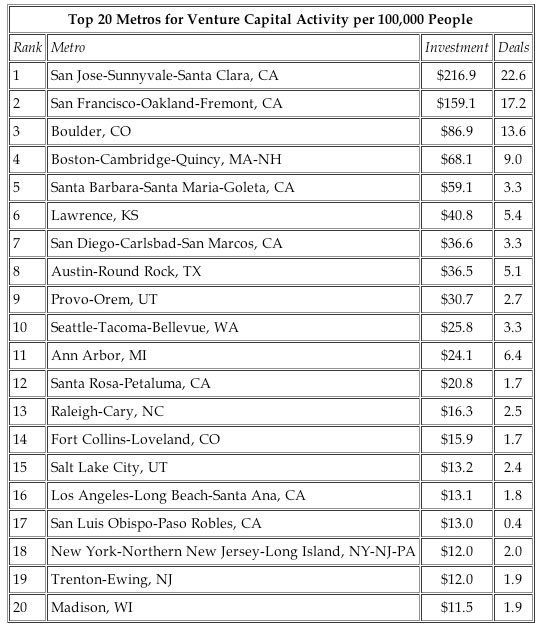

Infographic – Team personality types and how to harness them

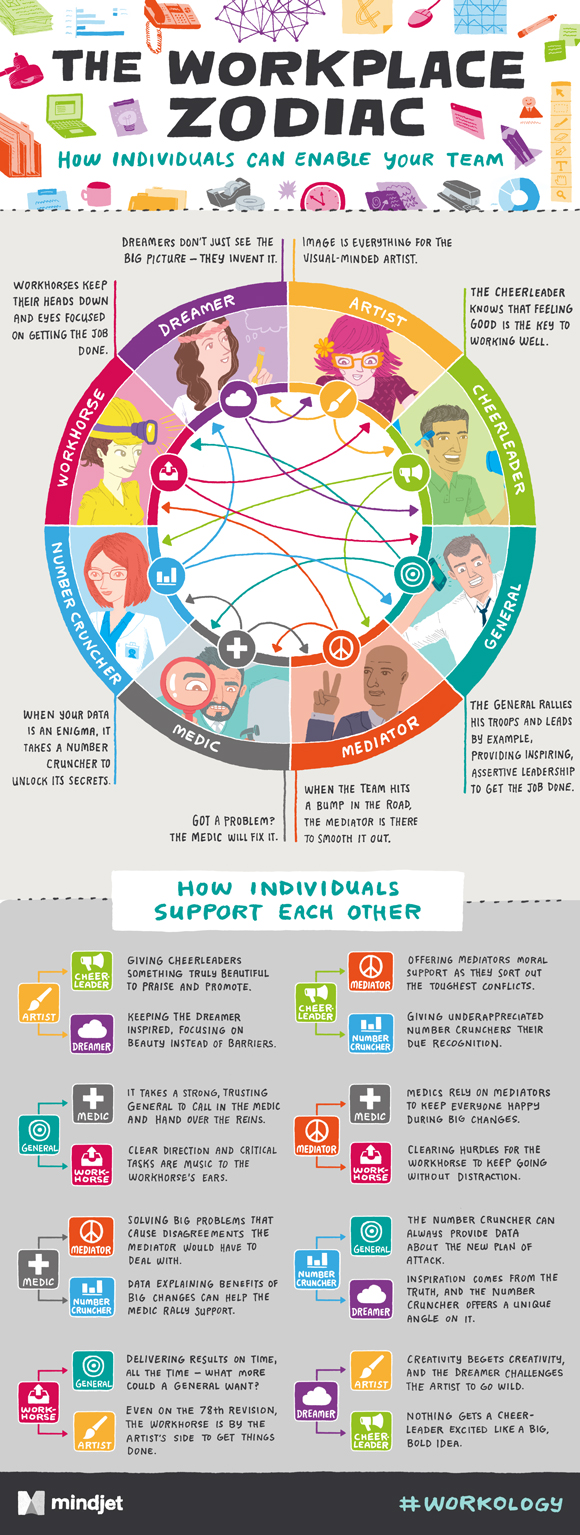

Infographic – Are You An Entrepreneur?

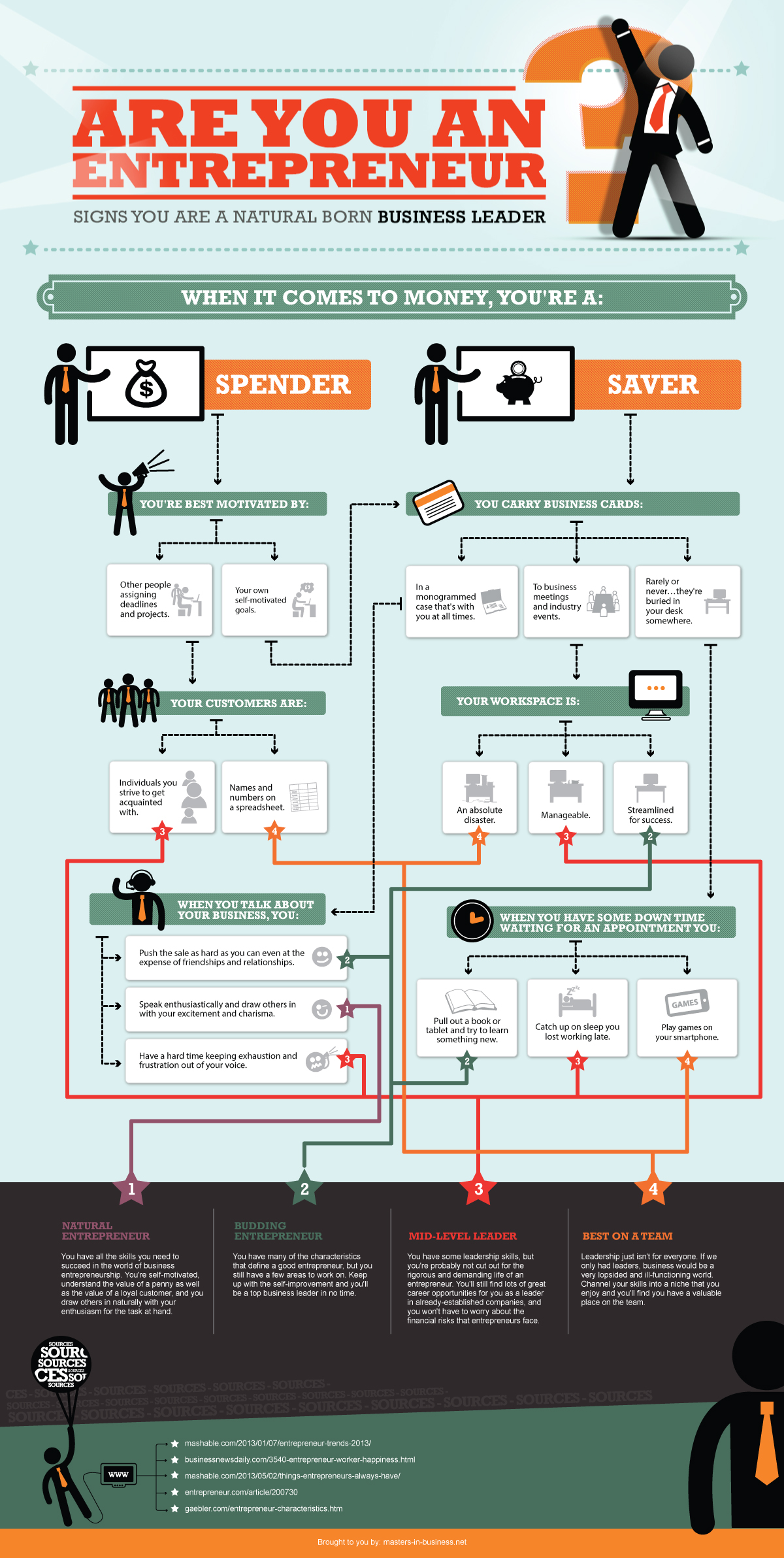

Infographic – How To Grow Your Business Using Content Marketing

40 Questions Venture Capitalists and Angel Investors Will Ask Startups

Here is a list of questions that angels and VC’s will ask startups when deciding whether to invest or not. If you have answers to these questions up your sleeve, you  should be pretty well prepared.

should be pretty well prepared.

The Idea:

- What does your business do?

- What problem does it solve?

Traction:

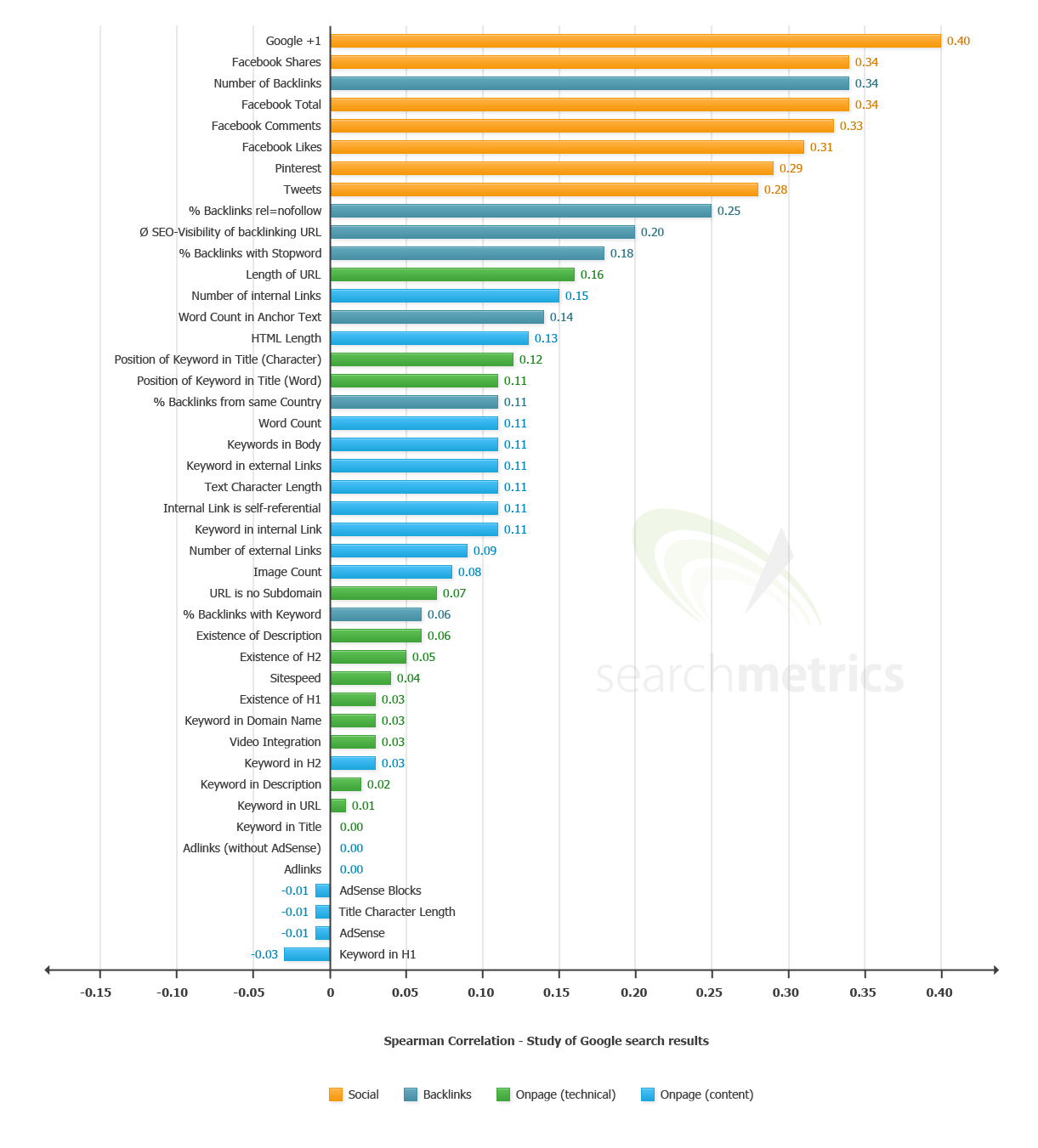

A list of the most important factors in SEO ranking

Infographic – The Marketing Benefits Of Social Media

This infographic from Wishpond collects data from a Social Media Examiner study into one, easy-to-read visual, looking at the top benefits achieved by social media by more than 3,000 marketers in 2013.

Highlights include:

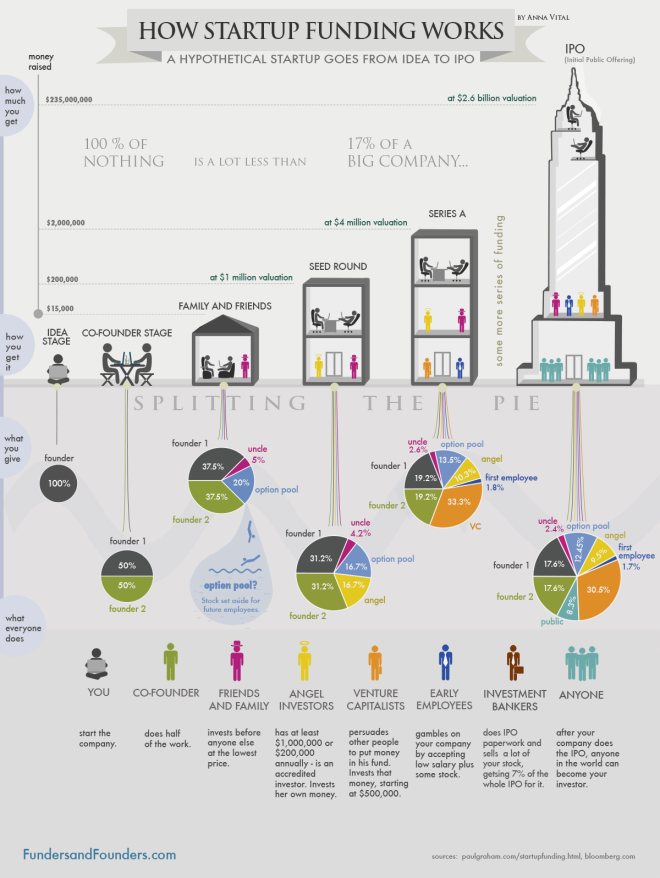

Infographic – How Funding Works – Splitting The Equity With Investors

20 Tips To Bootstrap Your Start-Up (And Hopefully Make Your Business More Investable)

Here are 20 tips to bootstrap your start-up and drive your business forward without spending a lot of money:

- Do customer surveys to find out about their level of interest in your product/service, how they would use it, what features they might like to see and how much they would consider paying for it.

- Raise money from family and friends. Family and friends can be a great source for bootstrap financing. They have a vested interest in your personal success, and are more likely to take a chance on you than a bank or angel investor.

- Approach industry experts to get feedback and endorsements. Do they like your product? Would they use it? Is it better than the existing competitors?

- Build yourself a website. There are loads of free and easy-to-use website builders like https://www.wix.com/ or https://www.moonfruit.com/.

- Offer people sweat equity in return for helping get the business off the ground.

- Set up a “coming soon” landing page and start collecting email addresses from people who’d be interested in joining your site when it launches.

- Pull in favors from friends or colleagues who may be able to help. Do you know a graphic designer who could do a mockup of your website? Do you know someone who has a contact at the retailer you’re desperately trying to get into? Using your contacts could be key in driving the business forward.

- Start building the right team as this is one of the main factors that investors will take into consideration when deciding whether to back you. Even if you can’t start paying them yet, you can have them on standby to join when you manage to raise some proper funding.

- Record a demo video of your product or service. This is a really effective way to showcase your business to customers and investors. You could either record one yourself or use a service like https://www.dunktank.co/ or https://explainify.com/.

- Hire interns and students. This is is a win/win for everyone. You get support at little to no cost. The intern/student gains valuable experience working at a startup where they’ll have more influence than they would at a larger company.

- Contact retailers to try to get some letters of intent or even pre-orders. This is a great way to prove there is interest in your product.

- Do some research to find out what sort of branding you’re going to use. This might just involve finding some other companies or websites you like the look of, so investors get an idea of what image you’re going for. Or you could use a site like Crowdspring (https://www.crowdspring.com/) to get a logo designed.

- Set up accounts and groups on Twitter, Facebook, Linkedin, Pinterest or any other social media sites you think your target audience use. This is a great way to start engaging with potential customers and industry influencers.

- Begin building partnerships that will allow you to grow your business faster through joint ventures, cross-promotion, referrals, content marketing, etc.

- Go to networking events to meet as many people as possible that are involved in your industry. This is a great way to meet potential clients, retailers, distributors, marketers, etc.

- Outsource jobs and use freelancers to get work done without having to take on employees.

- Start tracking stats as soon as possible. The sooner you establish your KPI’s (key performance indicators), the sooner you will be able to calculate your growth rate and determine which factors (like a new marketing strategy or website adjustment) have a positive impact on those KPIs.

- Develop your marketing strategy (and maybe even test it to determine your cost per acquisition and which marketing channels are the most effective).

- Assemble a team of expert advisors that you can approach for critical input and advice when you need it. It’s important to remember: You don’t have to do it alone!

- Don’t get an office – Google and Microsoft started in garages, so there’s no shame in it.

Clever bootstrapping is proof that you have the most important elements of company building: passion, dedication, resourcefulness, focus and vision, which will make you and your company much more attractive to angel investors and venture capitalists. So make sure you spend wisely! Be sure also to hire reputable payment processing companies for your business.

What have I forgotten? Let me know your top bootstrapping tips and strategies.

Full presentation: Top 10 Investor Pitch FAILS from SpringBeta!

Kraettli Epperson talks about some of the bad pitches companies make to investors at the spring beta 2013 conference.

Infographic – The most active investors in Europe revealed

According to a recent report from Dow Jones VentureSource, German seed investor High-Tech Gründerfonds (HTGF) is the most active investor in European companies – with 16 completed deals in the first quarter of 2013. Danish VC firm SEED Capital with 12 completed deals in the same period.

The UK retained its position as the favoured destination for equity financing in Europe with a 34% share of all investment into European VC-backed companies.

While European venture capital declined in the first three months of the year – dipping 13 per cent in the number of funds and five per cent in amount raised from the previous quarter – VC investment into European companies experienced a slight increase.

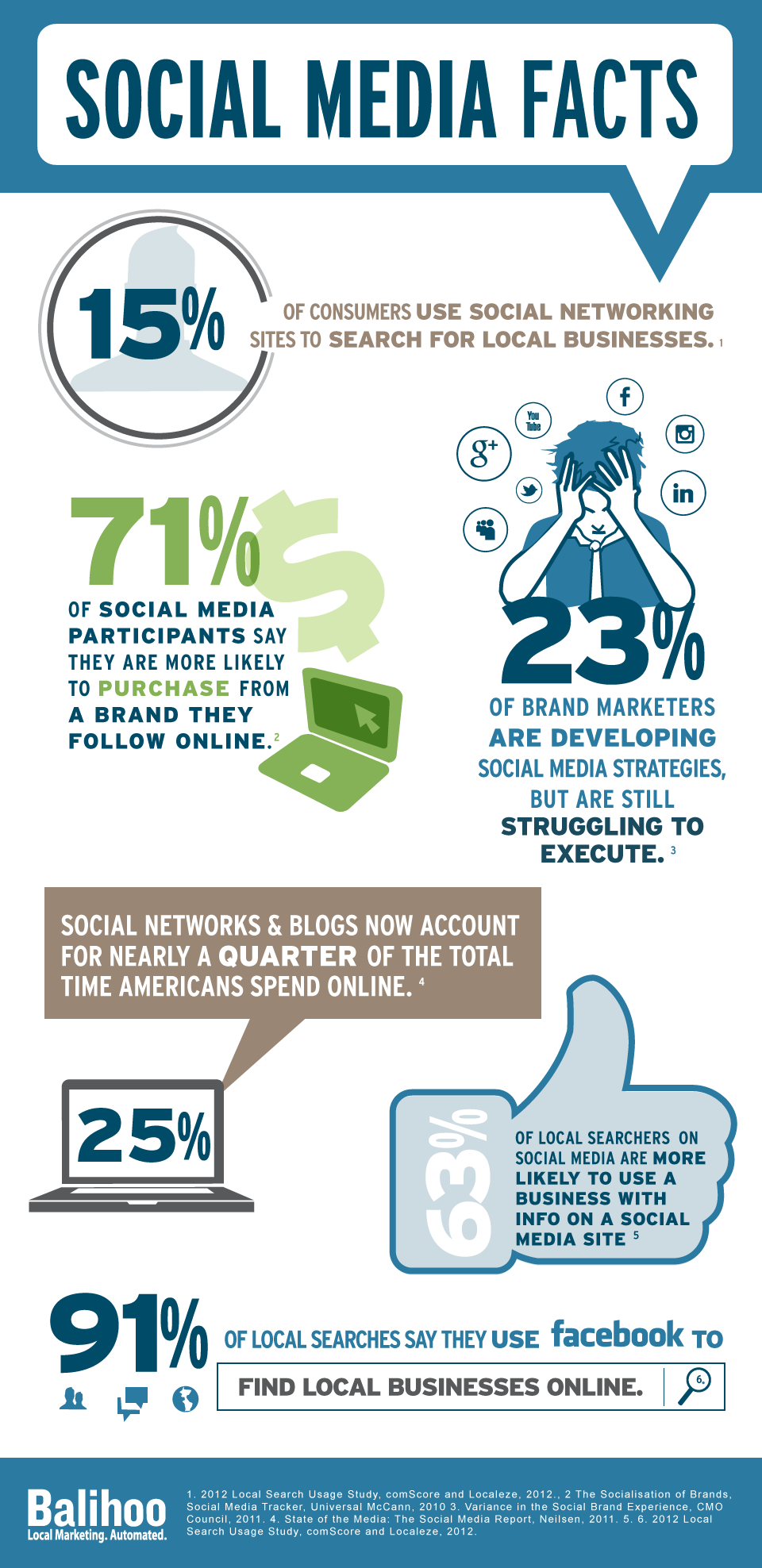

Infographic – 6 Amazing Social Media Statistics For Brands And Businesses

9 Characteristics Of An Entrepreneur

Infographic – Social Media Is Not Only For Marketing Your Business

Today it’s not enough for small businesses to solely use social media for their immediate marketing needs. They need to sew it through the fabric of their entire business strategies – from customer service to collecting and prioritizing ideas – in order to derive the most value.

This infographic from Get Satisfaction shows how small businesses can go beyond just marketing by using well-set social media channels to respond immediately, 24/7, to customer concerns while projecting a more personal approach to customer service.

Anatomy of Seed – An inside look at a $1M seed round

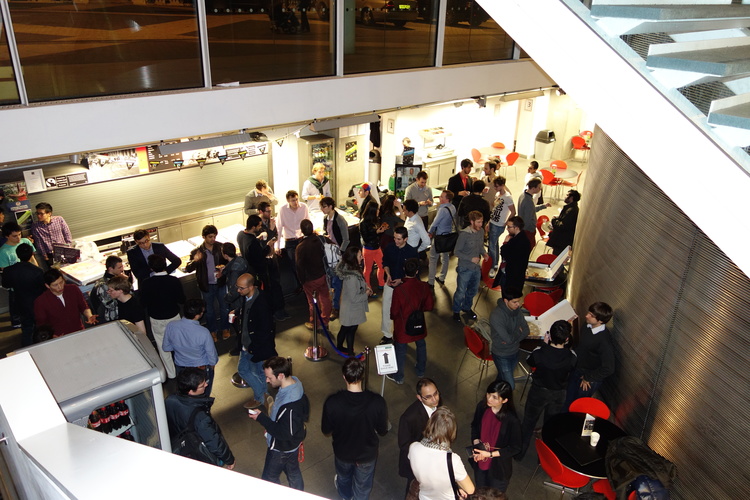

First ever Imperial Startup Weekend a huge success

Angel Investment Network were delighted to be involved as both judges and mentors at the first ever Imperial Startup Weekend, which saw 65 budding Entrepreneurs assemble in the basement of Skempton Building, Imperial College. A total of 10 teams worked on new business ideas for 54 hours in a frenzy of customer validation, business model planning, coding and design.

Here is some info from Stuart Brameld, Event Director about the companies and teams at the event:

1. Giglist (Winners)

Team Members: Tomasz Nguyen, Phil Thomas, Sahil Chugani

Seizing Singapore’s Advantage as a Gateway to Asia

Dubbed as the ‘Asian Century’, the economic growth of Asia is seeing no signs of distress.  China and India are not the only stars of this sparkling economic skyscape but smaller economies are emerging as the rising starlets. The economic might of Asia is growing in mammoth proportion; it is both a destination and a source of investments. Hence, you can also Interim Home Healthcare Franchise to promote economic growth. The upward trajectory of Asian economy is unperturbed by the turbulence in the west and this is evident from the increased FDI inflows into the Asian economies. Closer scrutiny of the FDI inflows reveals that China is loosing steam and ASEAN is closing in on the race for FDI. South East Asia’s share of the global FDI inflow has risen to 7.6% almost close to the 8.1% share of China, the largest FDI recipient globally.

China and India are not the only stars of this sparkling economic skyscape but smaller economies are emerging as the rising starlets. The economic might of Asia is growing in mammoth proportion; it is both a destination and a source of investments. Hence, you can also Interim Home Healthcare Franchise to promote economic growth. The upward trajectory of Asian economy is unperturbed by the turbulence in the west and this is evident from the increased FDI inflows into the Asian economies. Closer scrutiny of the FDI inflows reveals that China is loosing steam and ASEAN is closing in on the race for FDI. South East Asia’s share of the global FDI inflow has risen to 7.6% almost close to the 8.1% share of China, the largest FDI recipient globally.

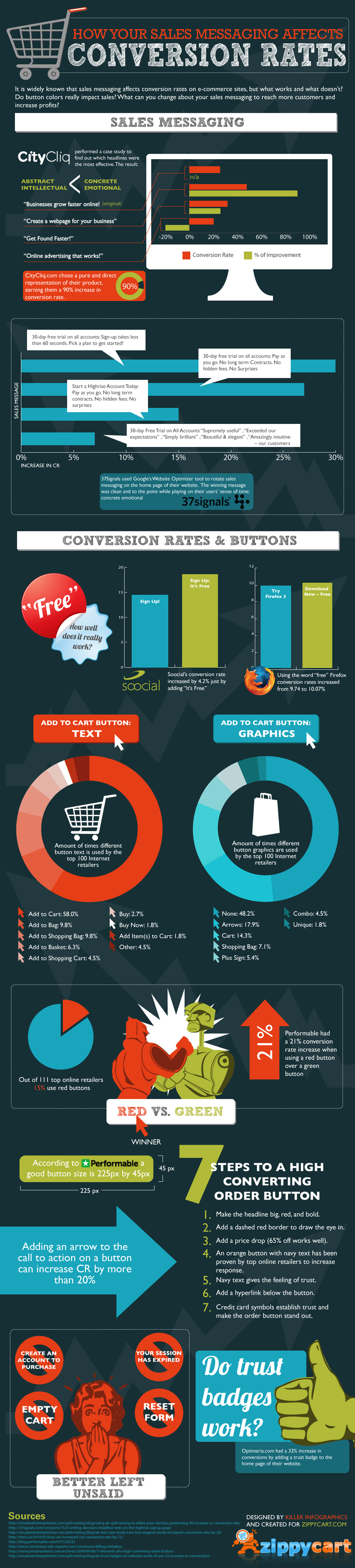

Infographic – How Sales Messaging Affects Conversion Rates

This infographic provides information for online sales and marketing tactics. It shows the different buttons on an internet shopping site and shows which messages and buttons produce more sales and which negatively effect sales. It shows the different tactics such as wording and button colour.

that online sales sites use in order to produce the most sales on their sites.

that online sales sites use in order to produce the most sales on their sites.

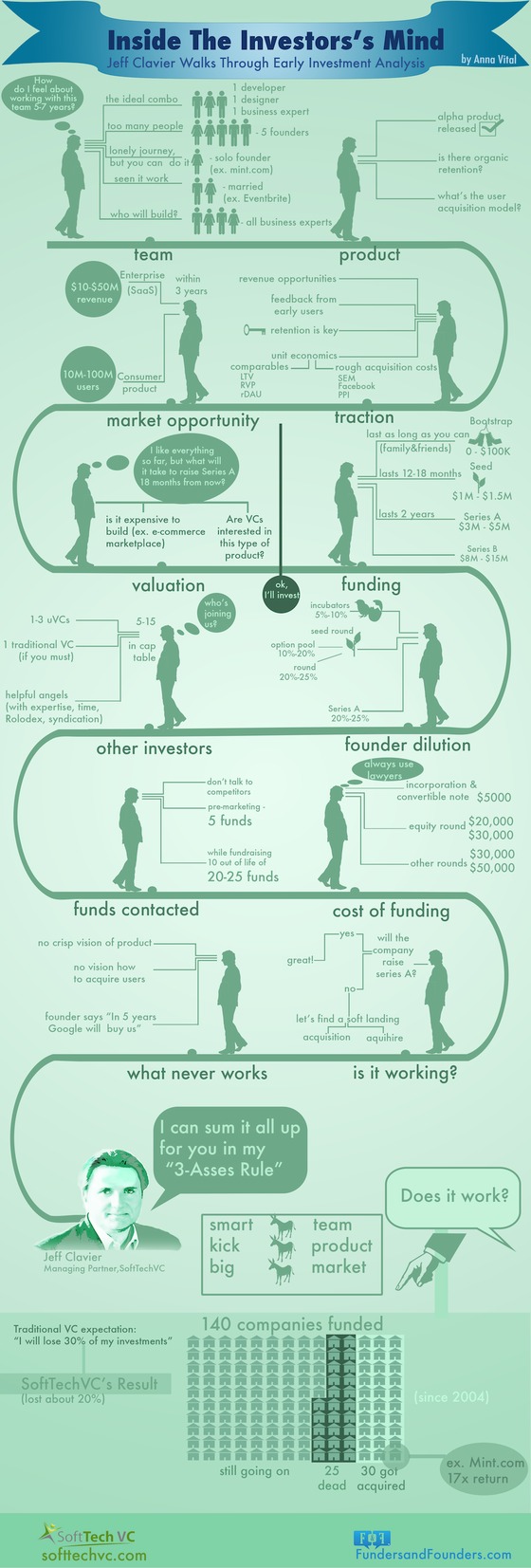

Infographic – Inside the Investor’s Mind

Infographic – Everything you need to know about Dragons’ Den in one excellent stat attack

From Oriental dipping sauces to a car parking space lettings agency, from a sausage manufacturing company to ice cream for dogs – the most recent series (can you believe it was the tenth?) of Dragons’ Den has continued to show that where there’s tat, there’s brass.

Or so the Dragons – Hilary Devey, Duncan Bannatyne. Deborah Meaden, Theo Paphitis and Peter Jones – hope, anyway.

Freshly updated to reflect all of the investments made right up to the wire of last night’s final episode, our lovely infographic has all the DD stats you could ever hope for.